|

|||||||||||||||||||||||||||||

In this Issue |

September 2016 Edition |

||||||||||||||||||||||||||||

| Presidents Message State News & Events Legislative Update - George Klaetsch Newly Designed 1003 Housing the Future Seminar WMBA Golf Outing 2016 2nd Annual Best in Business Awards Chapter News & Events |

There is MUCH going on in the WMBA!

I just returned from the very well attended inaugural Northeast Chapter Roundtable discussion form. Watch for one of these forums coming to a location near you. They are a great place to talk about issues, learn you are not alone in your concerns, network and get good feedback. Madison’s 2016 kick off will be completed by the time you read this but they have another great program on October 20th titled “Myth of Engaging and Retaining Millennials” that you will want to attend. Thanks to Matt Pierce and Mark Conrad for putting on a wonderful golf outing at the Broadlands on September 8th! We had 100 golfers for the event and EXCELLENT weather. Mark your calendar for the 2nd annual WMBA Best in Business Awards on October 27th in Madison at the beautiful Concourse Hotel and Governor’s Club. This is a can’t miss event where our association recognizes the best and brightest among us. Come to support your friends and colleges who are finalists and enjoy a great dinner and revelry as you utilize the three cocktail bars that are set out for you! In an effort to grow our association, your leadership team will be sending letters shortly to the financial institutions in our state that are not currently members. If you know of shops that should be members that have not yet done so, contact them on your own so you can participate in the financial incentive the state board of directors set out for you. One half of the first year of new member dues will be allocated back to the Chapter bringing in that new member. In addition, a $50 bonus will be paid to the individual WMBA member who recruited that new member. Lastly, our new social media intern Justin has set us up with a few new accounts. We now have a Facebook page (@WiscMBA),an Instagram account (mba.wisc) and we still have or Linkedin account too. Please sign up for all of these. Fun, interesting and insightful content is on its way to each site! Get Involved!

Legislative Update - George KlaetschHandicapping Wisconsin’s Targeted State Senate Races

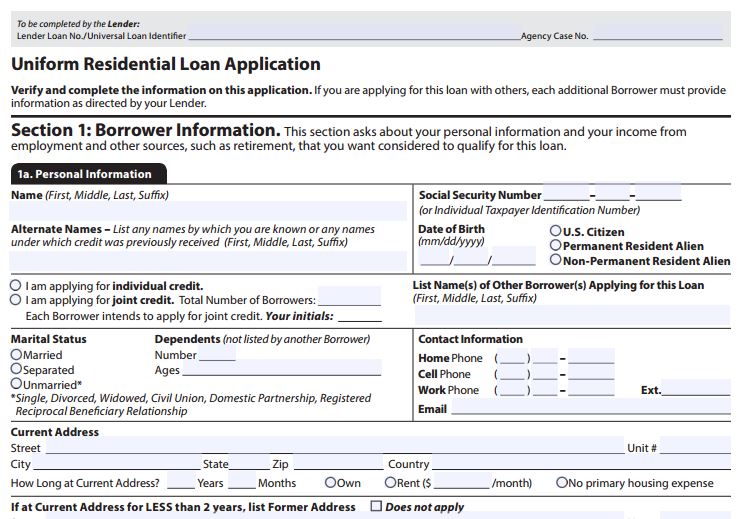

The only reason anyone is even talking about this seat is because former state Sen. Dan Kapanke, R-La Crosse, is making a run at his old job. But many insiders just don't see a path to victory for him against Sen. Jennifer Shilling, D-La Crosse. Kapanke was once viewed through somewhat of a non-partisan lens. But insiders say that was stripped away over his challenge of U.S. Rep. Ron Kind, D-La Crosse, in 2010, his vote for Act 10 and his 2011 loss to Shilling in the recalls. Some Republicans still argue Kapanke can find that old touch and rise above the district's numbers. But as much as they may want him back in the Senate in their hearts, some say, they know in their minds it's not likely to happen. Return to TopNewly Designed 1003Fannie and Freddie have unveiled a newly designed 1003. The new design is supposed to be more consumer friendly and more efficient for all users. If you want to take a sneak peak, click here. For more information and to view the dataset, click here. It cannot be used until Jan 2018. WMBA members to speak at the Housing the Future SeminarRegister today to secure your spot at the 2016 Wisconsin Real Estate and Economic Outlook Conference! You’ll connect with more than 160 professionals to discuss the trends and issues that are shaping the real estate and banking industries today. Keynote presenters include Ron Peltier, Chairman and CEO, HomeServices of America, Inc. and Michael Stegman, Fellow for Housing Policy at the Bipartisan Policy Center and Former Senior Advisor for Housing for The White House.

Other cutting-edge topics include: · The Times are a Changin’: Adapting to Shifting Housing Market Demands · Transformations in Housing Finance: What’s on the Horizon? This session features WMBA President Michael Kellman, Past President Nicholas DelTorto and member Geoff Cooper

· Housing Policy: Current and Future Challenges

· Building a Housing Policy that Works

· A View from the Top: Trends that are Shaping the Housing Industry Last year’s conference sold out so register soon at go.wisc.edu/outlookconf. Questions? Contact Lee Gottschalk at lgottschalk@bus.wisc.edu or (608) 265-2032.  WMBA Annual Golf OutingThe annual golf outing had a new home this year at the Broadlands Golf Club in North Prairie. Nearly 100 golfers hit the links on a beautiful sunny day to

network and support WMBA. Congratulations to the winning team of David Taylor (Wisconsin Title Services), Chris Gebert (Keller Williams), Collin Schlicht (GSF Mortgage) and Chris Zehern (Wells Fargo).

|

||||||||||||||||||||||||||||

43rd Annual WMBA Real Estate Finance ConferenceApril 6-7, 2017

Potawatomi Hotel, Milwaukee |

44th Annual WMBA Real Estate Finance ConferenceApril 16-17, 2018

Hyatt Regency Hotel, Milwaukee |

Return to Top  |

Madison Chapter Fall Kick-Off Event

The Madison Chapter held its annual Fall Kick-Off event on September 22nd. Approximately 60 industry professionals attended to enjoy networking with other members and start off the 2016-2017 year. Two awards are traditionally handed out at this event; the recognition of the service of the past year’s President and the “Distinguished Service Award," which is a decades old Madison tradition to recognize a member for their exemplary service to our industry and the Madison Chapter.

Please join in congratulating Cheryl Paul, of Settlers bank for her service as the 2015-2016 Chapter President. Cheryl is seen below receiving her award from incoming President Rob Helvey of Waukesha State Bank. Additionally, Steve Hansen of Associated Bank was recognized as the Distinguished Service Award winner. Steve is pictured below with Amy Gile-Enge, of Capitol Bank, the 2015 Distinguished Service Award winner and Jim Wilson of Associated Bank who introduced him and outlined his amazing accomplishments. Congratulations to these members and the Madison Chapter is looking forward to another great year!

|

Myths of Engaging and Retaining MillenialsOctober 20, 2016

|

Milwaukee

|

|

Northeast

|

|

|

MBA Education Releases HMDA, Diversity Resource Guides

WASHINGTON, D.C. (September 20, 2016)- The Mortgage Bankers Association's training and education division, MBA Education, today announced the release of two key MBA Compliance Essentials resource guides: Home Mortgage Disclosure Act (HMDA) Resource Guide and Diversity/Section 342 Resource Guide.

"These resource guides are designed not only to be an ongoing point of reference for the lenders and industry participants who purchase them, but a tool which helps the reader understand the nature of the rule," said Ken Markison, MBA Vice President and Regulatory Counsel. "Both the HMDA and Diversity resource guides are essential for industry stakeholders."

The HMDA Resource Guide walks purchasers through the new requirements within the rule, institutional and transactional coverage, data reporting, and Fair Lending implications. Policies, procedures, and checklists for compliance are all included. The guide is authored by Michael Flynn, a partner at Goodwin Proctor LLP, and Mitch Kider and Leslie Sowers, Managing Member and Member respectively at Weiner Brodsky Kider PC.

The Diversity/Section 342 Resource Guide is authored by Anthony Sharett, a partner at Baker Hostetler, and contains not only an overview of the rule, but tools for self-assessment, policies and procedures, and best practices to promote diversity within a company's organization and amongst their suppliers.

MBA Education also released two other guides, the Social Media Resource Guide by David Stein, Of Counsel, Brickler & Eckler, LLP and an update to the CFPB Examination Manual, authored by Donald Lampe, Partner, Morrison & Foerster, LLP. You can find information on how to purchase any of MBA's resource guides here.

###

ABOUT MBA

The Mortgage Bankers Association (MBA) is the national association representing the real estate finance industry, an industry that employs more than 280,000 people in virtually every community in the country. Headquartered in Washington, D.C., the association works to ensure the continued strength of the nation's residential and commercial real estate markets; to expand homeownership and extend access to affordable housing to all Americans. MBA promotes fair and ethical lending practices and fosters professional excellence among real estate finance employees through a wide range of educational programs and a variety of publications. Its membership of over 2,200 companies includes all elements of real estate finance: mortgage companies, mortgage brokers, commercial banks, thrifts, REITs, Wall Street conduits, life insurance companies and others in the mortgage lending field. For additional information, visit MBA's Web site: www.mba.org.

Return to Top

Mortgage Action Alliance - Action Week

Mortgage Action Alliance - Action Week is a weeklong event, held October 3-7, dedicated to helping real estate finance professionals learn how to become more engaged in political advocacy that supports our industry.

Our goal is to raise the MAA membership from 12,000 to 15,000. The more MAA members we have, the stronger our voice will be as we play an active role in how laws and regulations that affect the industry and consumers are created and carried out. Help us reach our goal by enrolling your company to participate and running a MAA membership campaign within your office.

Your time is important so we have put together a kit for all of our volunteers with sample letters and promotional materials to make participation in Action Week as easy and successful as possible. Once you sign up below, we will send you your kit.

Sign Up

Sign up to take part either as an individual branch or as a company. Fill out this form by Friday, September 30.

You will receive a tool kit with resources to support your Action Week activities as well as daily updates and tips to distribute in order to encourage colleagues to participate in the Mortgage Action Alliance (MAA). After Action Week is over, prizes will be awarded to participating branches or companies based on a number of factors, with company size taken to in consideration.

|

The WMBA and the MBA have teamed up to bring you great access to the education components you need to stay current in the Mortgage Banking Business. For every product purchased through the WIMBA-MBA store the WMBA receives a % back. Please use the link below to help support our Association! Wisconsin Mortgage Bankers Online Store Remember to check back often! |

As we enter the final 50 days of the election cycle, many of you live in districts with targeted races. The following is in-depth handicapping of the top senate races, courtesy of WisPolitics.

As we enter the final 50 days of the election cycle, many of you live in districts with targeted races. The following is in-depth handicapping of the top senate races, courtesy of WisPolitics.

2nd Annual Best in Business Awards

2nd Annual Best in Business Awards